Financial Planning with MassMutual Pittsburgh

At MassMutual Pittsburgh, we believe in a holistic approach to financial planning that goes beyond the numbers—it's about understanding our clients' unique dreams, aspirations, and values in order to create comprehensive strategies that enrich their lives.

As a financial planner with our firm, you’ll have access to a whole team of individuals who are trained to assist you in guiding your clients through every aspect of their financial journey. Our goal is to help your clients achieve true financial wellness, and at the same time, elevate your business to the highest level of success.

Our Financial Planning Department

Carmella Stamm

Director of Financial Planning

|

Benjamin Demblowski Paraplanner

|

Anthony Sandora Paraplanner

|

Cindy McKay Licensing & Contracting Coordinator

|

The Financial Planning Department at MassMutual Pittsburgh provides ongoing support and training to advisors, equipping them with the knowledge and tools needed to navigate evolving industry trends and deliver exceptional service to clients. This collaborative approach, led by Director Carmella Stamm, ensures that advisers will receive comprehensive support throughout the various stages of financial planning, including data input, research, plan tracking, individual consultations, and plan deliverables.

What distinguishes a Fee-based Planner at MassMutual Pittsburgh?

We believe that Financial Planning takes a holistic approach that begins with education. It is a collaborative effort, where advisors work with clients in a fiduciary capacity, to help uncover needs the client may not have recognized before starting the financial planning process.

• The primary objective of our financial planners is to educate clients so that they can make informed decisions about their financial future.

• By not leading with products, advisors are better positioned to discover their clients’ goals and expectations first, then advise them on the products that will help them achieve those goals.

Learn more by contacting our recruiting team.

Why Implement Financial Planning in Your Practice?

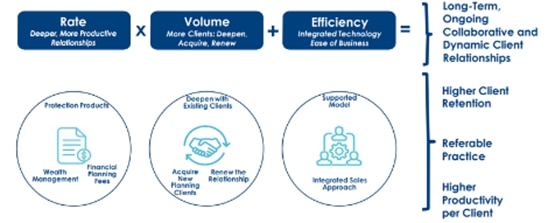

Incorporating fee-based planning into your practice offers several benefits, including:

- A unique opportunity for advisors to illustrate and share the framework that forms the foundation of a successful financial plan, so that clients can fully understand the “why” behind recommendations, and the impact those recommendations will have on their financial situation.

- An ongoing revenue stream for advisors, which significantly impact product-based revenue through implementation of both the investments and protection products.

- Ability to have more dynamic Client Relationships, higher Client Retention, and higher Productivity per client.

Financial Planning: A Systematic Approach

The model for developing an initial Financial Plan and creating an ongoing relationship with your client through fee-based financial planning is illustrated in the timeline below.

Interested in developing your fee-based financial planning practice with MassMutual Pittsburgh?

Financial planning services are offered only through approved Financial Planners of MML Investors Services, LLC.

Local firms are sales offices of Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and are not subsidiaries of MassMutual or its affiliated companies. Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC Supervisory Office: Six PPG Place, Suite 600, Pittsburgh, PA 15222, Phone: 412-562-1600.

FOR RECRUITING PURPOSES ONLY. NOT FOR USE WITH THE PUBLIC